The most shocking videos in the world! This video actually shows us what the secret of the Trump family is related to their expressive health!!! Full Video.

The writing is on the wall and the elites are conducting a last-ditch operation to take it all.

Historically, the expansion of the middle class was supported by the balance of power between capital owners and labor. When labor was scarce – such as after the Black Death – the average citizen was able to negotiate better working conditions and pay.

More recently, cheap and abundant energy created an economic surplus that could support policies strengthening the middle class. However, as energy – and resources in general, including food – becomes more scarce, the middle class will become a passing phenomenon.

Why Care About the Middle Class?

A robust middle class reduces disparities between the rich and the poor, which helps prevent resentment, crime, and political unrest. In societies with extreme inequality, divisions between economic classes deepen, fueling instability and disenfranchisement. A broad middle class promotes inclusivity and shared prosperity, encouraging a sense of unity and national identity.

The middle class also helps maintain democratic institutions. When economic power is highly concentrated among a small elite, political influence follows, leading to policies that favor wealth preservation rather than broad-based economic opportunity. A strong middle class balances the political landscape, where policies are created with the broader population in mind rather than serving only the interests of the wealthy.

Without a thriving middle class, society becomes increasingly polarized, with a struggling lower class and an isolated elite. This leads to rising populism, greater social unrest, and an erosion of democratic institutions.

How Wealthy Elites Squeeze Out the Middle Class

For decades, the middle class was the backbone of economic stability. It represented upward mobility, financial security, and shared prosperity. But with the onset of trickle-down economics, this group has been squeezed from all sides – stagnant real wages, rising costs of basic needs, and financial policies that favor asset holders over workers.

Government responses to economic calamities have accelerated this trend, starting with the Long-Term Capital Management bailout in 1998. Every major systemic risk over the past 30 years has been papered over by bailouts and quantitative easing (QE), which disproportionately benefit those who already own assets.

QE, introduced during the 2008 financial crisis, was meant to stimulate the economy by injecting liquidity into financial markets. The theory was that this would encourage investment and job creation, but in practice, it primarily inflated asset prices – stocks, real estate, and bonds – benefiting those who already owned them.

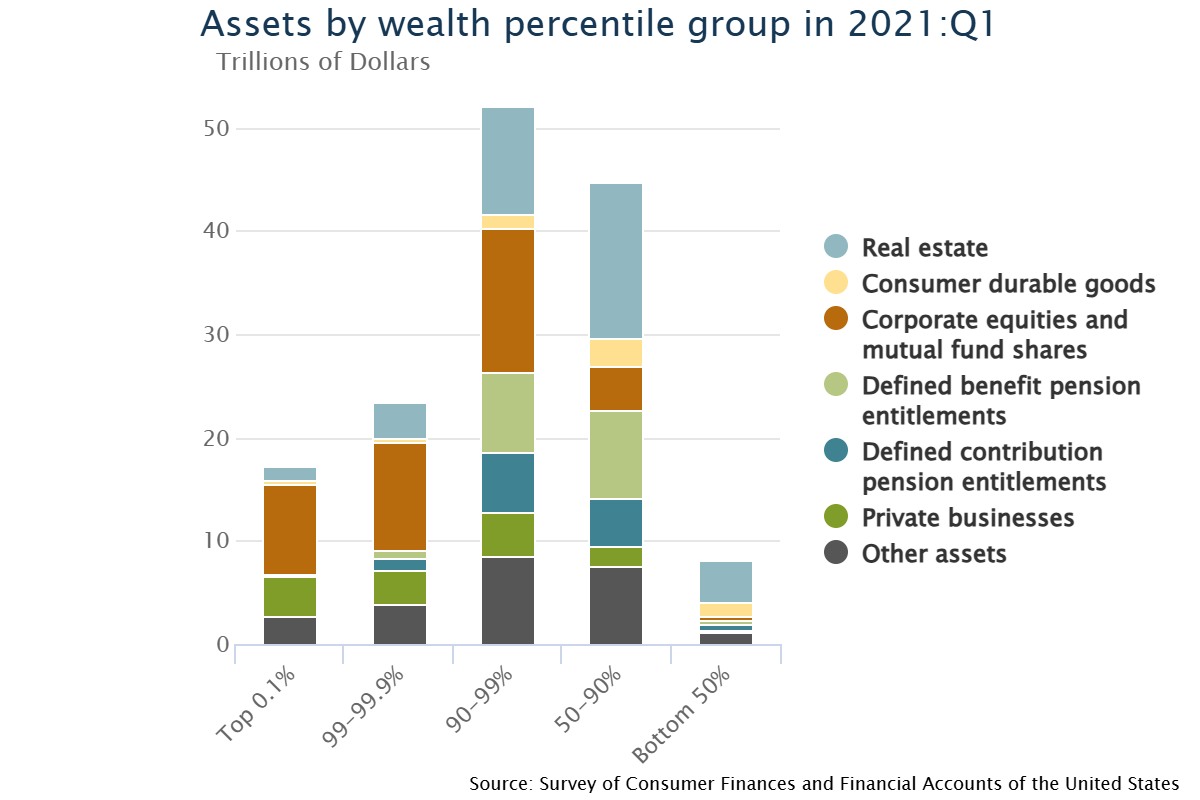

From 2009 to 2021, the stock market saw one of the longest bull runs in history, yet real wage growth remained weak. The top 1% of Americans own over 50% of all stock market assets, while the bottom 50% own less than 1%. When central banks pump trillions into the system, stock prices rise, making the rich richer while the majority see little benefit.

At the same time, low interest rates encouraged corporations to engage in massive stock buybacks rather than reinvesting in workers. CEOs and executives reaped the rewards while wages stagnated. The result has been an economy where wealth accumulation is increasingly tied to asset ownership rather than labor.

Bailouts and QE create a moral hazard by socializing losses and privatizing gains, encouraging even riskier investment decisions and economic policies. Consequently, wealth inequality has reached historic levels, with the top 0.1% now controlling more wealth than half the US population.

Housing, Education, and Healthcare

The ultra-wealthy, with their financial safety nets, have used their excess capital to drive up the cost of essentials – housing, education, and healthcare. With greater disposable income and an expanding asset base, the rich are willing to pay more, pushing up prices for everyone.

Housing has become one of the biggest barriers to middle-class stability. Ultra-wealthy investors, foreign buyers, and institutional landlords have driven up real estate prices beyond what most families can afford. In major cities like New York, London, and Toronto, high-income buyers pay massive premiums for desirable locations, encouraging developers to cater to luxury demand rather than build affordable housing. Families that could have once afforded homes are now priced out, forced to rent indefinitely or relocate to less desirable areas. Institutions like BlackRock have only accelerated this trend, turning housing into an investment vehicle instead of a fundamental need.

Education is another sector where the wealthy have distorted pricing. Families with unlimited resources can pay astronomical tuition fees for elite universities, allowing schools to continue raising prices. Public universities, which once offered an affordable path to upward mobility, have also become prohibitively expensive due to funding cuts and rising administrative costs. The result is a student debt crisis that leaves middle-class graduates burdened for decades, while the children of the elite graduate debt-free and with better connections.

Healthcare has followed a similar pattern. The wealthy can afford private care, giving them better access to top doctors and faster treatment. Meanwhile, middle-class and lower-income families face longer wait times and declining healthcare quality as public systems struggle with underfunding. In countries like the U.S., concierge medicine has made this disparity even worse. Those who can pay for exclusive healthcare services receive premium treatment, while the rest are left with overburdened hospitals and insurance nightmares.

Generally, when the supply of a good or service is constrained, the marginal buyer willing to pay more resets the bar for everyone. Suppliers will cater to that marginal buyer, driving up prices industry-wide.

Historical Example: India’s Rice and Tea Crops

A historical example of economic manipulation at the expense of the majority can be seen in colonial India.

During British rule, rice crops, a staple food for millions of Indians, were increasingly replaced by tea crops that could be sold at higher prices through export to England. Demand from English consumers willing to pay for a more expensive crop diverted cropland away from staples, reducing supply, making rice more expensive for Indian consumers.

The consequences were devastating, as food shortages and famines followed, highlighting how economic policies driven by elite interests often come at the direct expense of the broader population. This is just one of many examples of how wealth inequality has historically been exacerbated across the world.

The Elite are Collapse-Aware

The rich and powerful are increasingly collapse-aware. For years, they made token PR-worthy attempts to slow its progression, but as collapse becomes more imminent, their strategy has shifted from public appeasement to outright wealth consolidation.

Virtually every policy being rolled out today further concentrates wealth and power among the elite. This is amplified by the rise of artificial intelligence, which will soon replace many jobs.

What may have once been an unintended consequence of economic policy is now a deliberate feature. The past 30 years have taught the wealthy that they are insulated from the economic hardships affecting the majority. Indeed, they are the only segment to benefit from policies meant to stabilize society, which instead transfer wealth upwards.

Learning from these lessons, they are now actively engineering economic collapse, believing they will be the main beneficiaries. Financial crashes have become wealth-accumulation events. What used to be unplanned destructive economic downturns are becoming carefully managed opportunities for the elite to grow even richer.

The cycle is clear: A crisis hits, sending markets into freefall. The middle class, living paycheck to paycheck, panics – losing jobs, selling off stocks, or defaulting on mortgages. Meanwhile, the wealthy, armed with cash and credit, buy up distressed assets at fire-sale prices. Then, as governments step in with bailouts and QE, asset prices rebound, making those who bought at the bottom exponentially wealthier.

In the long run, this strategy is doomed to fail. As much as they believe it, the wealthy can’t eat money.

But for now, the elite are paving the way for a neo-feudal society, where a handful of people control remaining resources leaving everyone else behind. Eventually, the masses will vanish into the fog of collapse and the 1% will sit alone comforted only by their stacks of paper.

Source- collapse2050.substack.com